The US Federal Reserve officials said that inflation has fallen further towards their target level in recent months but signalled that they expect to cut their benchmark interest rate just once this year.

The policymakers’ forecast for one rate cut was down from a previous forecast of three, probably because inflation, despite having cooled in the past two months, remains persistently elevated.

In a statement issued after its two-day meeting, the Fed said the economy is growing at a solid pace, while hiring has “remained strong”.

The officials also noted that in recent months there has been “modest further progress” towards its 2% inflation target.

That is a more positive assessment than after the Fed’s previous meeting on May 1, when the officials said there had been “a lack of further progress” on inflation.

Still, the central bank made clear on Wednesday that further improvement is needed.

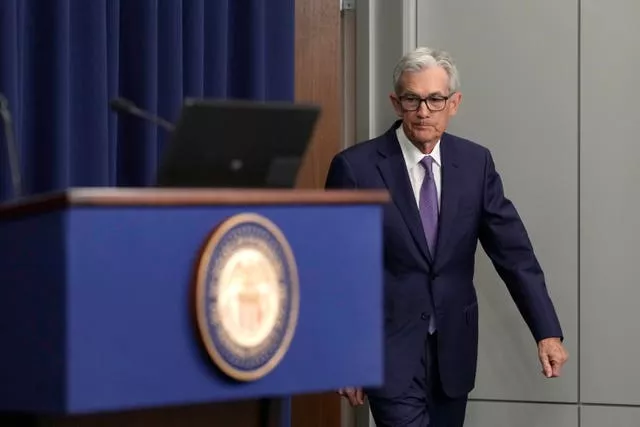

“We’ll need to see more good data to bolster our confidence that inflation is moving sustainably towards 2%,” chairman Jerome Powell said at a news conference after the Fed meeting.

The policymakers, as expected, kept their key rate unchanged at roughly 5.3%.

The benchmark rate has remained at that level since July of last year, after the Fed raised it 11 times to try to slow borrowing and spending and cool inflation.

Fed rate cuts would, over time, lighten loan costs for consumers, who have faced punishingly high rates for mortgages, car loans, credit cards and other forms of borrowing.

The officials’ rate-cut forecast reflects the individual estimates of 19 policymakers. The Fed said that eight of those officials projected two rate cuts and seven projected one cut. Four said they envisioned no cuts at all this year.

The Fed’s updated quarterly projections are by no means fixed in time. The policymakers frequently revise their plans for rate cuts – or hikes – depending on how economic growth and inflation evolve over time.

On Wednesday morning, the government reported that inflation eased in May for a second straight month, a hopeful sign that an acceleration of prices that occurred earlier this year may have passed.

Consumer prices excluding volatile food and energy costs – the closely watched “core” index – rose just 0.2% from April, the smallest rise since October. Measured from a year earlier, core prices climbed 3.4%, the mildest pace in three years.

Though inflation has tumbled from a peak of 9.1% two years ago, it remains too high for the Fed’s liking. The policymakers now face the delicate task of keeping rates high enough to slow spending and defeat high inflation without derailing the economy.

The central bank’s rate policies over the next several months could also have consequences for the presidential race.

Though the unemployment rate is a low 4%, hiring is robust and consumers continue to spend, voters have taken a generally sour view of the economy under President Joe Biden. In large part, that is because prices remain much higher than they were before the pandemic struck. High borrowing rates impose a further financial burden.

Inflation had cooled steadily in the second half of last year, raising hopes that the Fed could achieve a rare “soft landing”, whereby it would manage to conquer inflation through rate hikes without causing a recession.

But inflation came in unexpectedly high in the first three months of this year, delaying hoped-for Fed rate cuts and potentially imperilling a soft landing.

As part of the updated quarterly forecasts the Fed’s policymakers issued on Wednesday, they projected that the economy will grow 2.1% this year and 2% in 2025, the same as they had envisioned in March.

They expect core inflation to be 2.8% by the year’s end, according to their preferred gauge, up from a previous forecast of 2.6%. And they project that unemployment will stay at its current 4% rate by the end of this year and edge up to 4.2% by the end of 2025.