The Bank of England is still likely to hike interest rates on Thursday, but this week’s lower-than-expected inflation figures give decision-makers a little more leeway than they otherwise would have had, economists said.

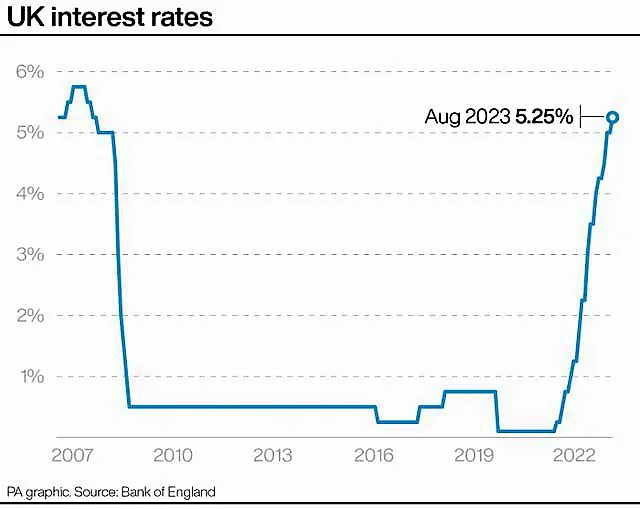

The Monetary Policy Committee had been widely expected to hike rates again, from 5.25 per cent to 5.5 per cent, which would be the highest base rate since February 2008.

Wednesday’s inflation figures did not change this outlook, economists said, but did make it less likely than before.

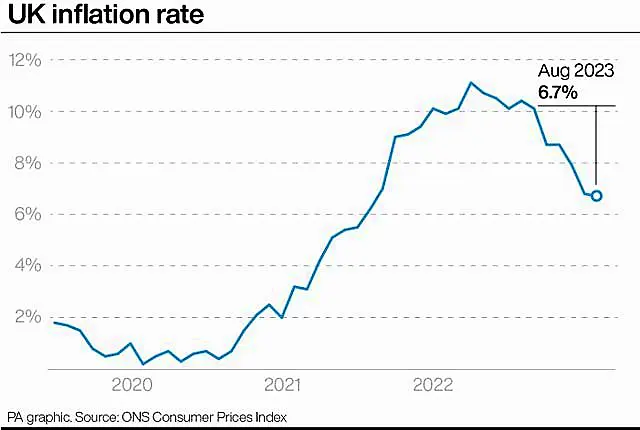

Inflation hit 6.7 per cent in August, down from 6.8 per cent in July, and significantly lower than the 7.1 per cent that had been expected.

The figures came as a shock to many, and are likely to have taken Bank decision-makers by surprise as well. Earlier in the month, governor Andrew Bailey said that recent rises in fuel prices probably meant that inflation would “tick up” in August.

The Bank had forecast inflation to reach 7.1 per cent during the month.

The Bank hikes interest rates to curb inflation, so the fact that inflation is lower than expected will have given decision-makers on the Monetary Policy Committee (MPC) more breathing room.

But experts at Investec Economics said that while headline and services inflation had both fallen below the August forecasts, growth in private sector pay had overshot the Bank’s outlook significantly.

The bank had forecast that pay would rise 6.9 per cent over three months compared to the year earlier. In fact, it appears to have risen 8.1 per cent.

“We think that it is this variable that will convince the Bank of England to increase the Bank rate once again tomorrow to prevent upside risks to inflation from crystallising,” Investec said.

They added: “We do not on balance think today’s softer numbers will change tomorrow’s decision – we continue to expect a 25 basis point hike to 5.5 per cent as our baseline case – but the risks around this have changed and more clearly it calls into question the November rate decision.”

It could therefore mean that if the Bank decides to hike rates this week, that might be the last time they do so, at least for a while.

Any increase would be the 15th hike to the Bank’s base rate in a row. It started upping rates from 0.1 per cent in December 2021 and has not missed a single opportunity to do so since then.

The increases have been an attempt to stem inflation, and the Bank’s Sarah Breeden, who is expected to join the MPC before November’s meeting, said this week she thought inflation could have been double the rate it reached without the Bank’s intervention.

But a rise on Thursday is far from certain. James Smith, a developed markets economist at Dutch bank ING, called the decision a “close call”.

“We’re still tempted to say the Bank of England will hike rates tomorrow, and some of the downside surprise in services inflation is down to volatile travel categories,” he said.

“But it’s a close call, and both wage and inflation data suggest the end of the current tightening cycle is very close to its conclusion.”

Debapratim De, senior economist at Deloitte, said: “Although many expect the Bank of England to raise interest rates by 25 basis points this week, today’s figures will give it some additional room for manoeuvre, should it choose to pause tightening instead.”