American investment firm 777 Partners have returned to the negotiating table at Everton but are now reportedly considering a majority purchase.

The group had been in talks earlier this summer over a partial investment only for rivals MSP Sports Capital to enter into an exclusivity agreement with Toffees owner Farhad Moshiri.

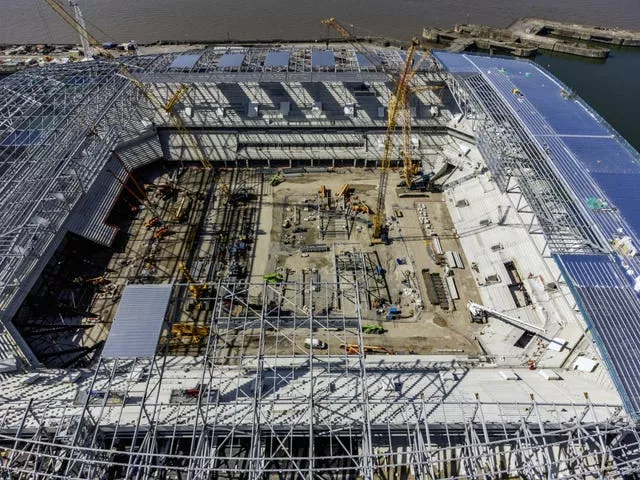

With the agreement now over after that potential investment fell through over repayments to existing lenders – although a £100million loan to help finalise the completion of a new stadium at Bramley-Moore Dock was agreed – it appears 777 have re-entered talks.

However, reports suggest it is with a view to a full takeover of the club.

Everton have been seeking outside investment for some time in order to free up finances to complete the new stadium.

In January Moshiri, who has spent more than £500million on players since becoming the majority shareholder in 2016, said the club was not up for sale but admitted he was exploring funding options to cover the final stages of the £550m-plus build at Bramley-Moore which will is set to see the ground opened next season.

The 777 group, which did not comment when contacted by the PA news agency, currently own, or part own, Genoa, Standard Liege, Hertha Berlin, Vasco de Gama and Melbourne Victory and the London Lions basketball team and British Basketball League.