Ulster Bank said it is confident that it has the resources to “handhold” vulnerable customers towards a new provider by the end of March, as it begins to freeze active accounts.

Around 2,000 active personal accounts will begin to be frozen from next week in what the bank told a committee was “the last attempt to engage with these customers”.

Its representatives said that 5,500 accounts which are receiving social welfare payments are being targeted to move to a new provider in the coming months before the bank’s withdrawal from the Irish market.

Around half of these accounts are in receipt of child benefit, with the other half receiving a broad range of social welfare payments such as pensions.

The Department of Social Protection and the bank are making efforts to engage with customers in areas where the numbers are highest, using social media and advertising campaigns.

Around 800 customers a week are changing from Ulster Bank as their main provider.

'Vulnerable customers'

“We are going to then get down into very small numbers of customers who potentially are very vulnerable customers,” Elizabeth Arnett, director of corporate affairs at Ulster Bank, told TDs and senators on Wednesday.

“We’re going to cross-reference those with our vulnerable customer team.

“We have individuals assigned across the bank who, for want of a better word, own each individual vulnerable customer, and we’re confident that those resources are in place to ‘handhold’ those customers out of the bank and into another service provider, the majority of whom will be done by the end of March.”

Ulster Bank and KBC appeared before the Oireachtas finance committee on Wednesday, to outline progress in the closing of thousands of accounts in the coming weeks.

Ulster Bank is to close its branches on April 21 this year – more than two years since it was first announced.

Accounts are closed if they have been given a six months’ notice period and there is little activity in their account, and a cheque is sent out to customers with the remaining amounts in their accounts.

In her opening statement, Ulster Bank chief executive Jane Howard said that since November, it has frozen around 126,000 accounts “that we believed customers were no longer reliant on”.

“This is based on less than five transactions in a 31-day period,” she added.

Ms Howard said that when these accounts were frozen, there was no spike in the opening of other accounts, which leads them to “categorically conclude” these are not being used as people’s main accounts.

“We did not freeze or close any known vulnerable customers’ accounts or accounts in receipt of Department of Social Protection Payments,” she said.

Ms Howard added that they are to begin freezing the 20,000 accounts that have gone beyond their six-month notice period from next week, freezing between 2,000-2,500 a week in a “phased, orderly manner”.

This will mean that funds cannot go in or out of the account.

She said: “I think these 20,000 customers, they sort of fall into two cohorts. We’ve got some who have been open with us and said ‘we’re just not going to go until you make us’, and then we’ve got others and we don’t know why they haven’t gone and they’re the ones that were most worried about.”

She said that 91 per cent of Ulster Bank personal current accounts are either closed or have five transactions or less in the past month, and 81 per cent of Ulster Bank business accounts are either closed or with minimal transactions.

Sinn Féin TD Pearse Doherty asked would people be still entitled to redeem cheques that had not been cashed in time.

“So the post could be landing, but it’s landing in a pile in the corner on a table,” he said.

“After six months, as you say, the cheque then is no longer legal tender and wouldn’t be capable of being cashed,” Ms Howard said.

“So we will be opening a trustee account and we will have a record of any customers who haven’t cashed their cheque, and will always have a right to that money.”

She said the vast majority of the accounts that have been closed have balances less than €10, but there are some accounts with more than €10,000.

“We’re not sending out a cheque in excess of €10,000 without doing more track and trace… to make sure you know for fraud and other reasons.”

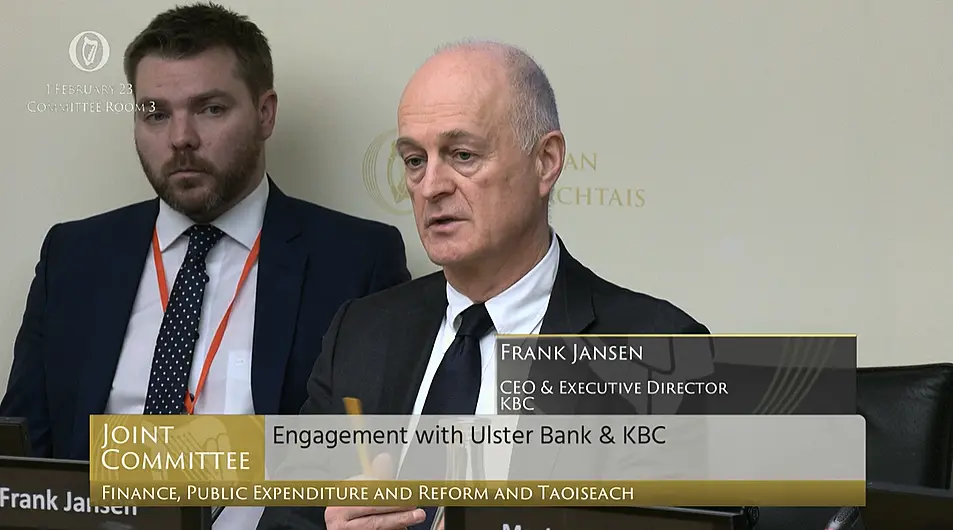

KBC Bank chief executive Frank Jansen said that in May 2022 it was estimated that 52,000 of its 130,000 current account holders would need to open a new account or move to a new provider.

He said that it is now estimated the number who need to open an account or move to a new provider is down 50 per cent to 26,000, and that all current account customers have received closure notices.

“Our plan as it looks today is that colleagues will leave over the next two years in a phased way and all our employees will be entitled to redundancy,” he said.

Ms Howard said that a small group of Ulster Bank employees will be retained in Ireland to deal with complaints, but the majority of colleagues will leave in 2023.

Ms Arnett said that they are informing their staff as best they can when their job will end.

She added: “There’s lots of other opportunities for colleagues and I think we’ve been very open to ensuring their colleagues are thinking along those lines and making sure that they’re availing of all of the additional training and supports.

“We’ve seen one colleague a year ago left to train as a midwife, so there’s lots of different opportunities for people and we’ve been encouraging people to think differently about it.

“But without a doubt, certainty as to when the change will happen is the most important thing for colleagues.”