FraudSMART, the fraud awareness initiative developed by Banking & Payments federation Ireland (BPFI), has warned of an uptick in investment scams targeting older people for funds of €20,000 and more.

Niamh Davenport, head of financial crime at the BPFI, told BreakingNews.ie: "We've been focusing the last few months on people who are 55+, pension age or preparing to retire, that age tends to have more money than younger people which makes them a target.

"With the cost-of-living and inflation people may be looking online thinking 'I'll take my pension lump sum but how can I ensure it lasts the rest of my life?'

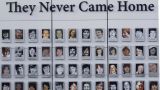

"They're not people with a spare €20,000 lying around. People working their entire lives and trying to invest for their future and the money is lost. It's devastating, your entire life's work gone. Banks try to question these transactions, but they can't always do that."

She encouraged people to "do their homework" on any investment companies, and make sure to speak with people on the phone.

While people should still proceed with caution, she said large payments should never be made by transfer without speaking to someone.

She also warned that texts and emails, even if they look official, should not be trusted.

"When people access their websites, for investment bonds or whatever, they look professional and have forms for follow-up calls. They're easy to fall for. One pay day is hugely profitable for them, one person being scammed can give them a year's salary for the average worker."

Text scams

On smaller scale scams involving text messages, Ms Davenport said banks will never ask for personal or financial information over text. She also said they will never send links for people to click on.

There has been a noticeable rise in scam text messages from banks.

However, she said the trend has now changed with the majority of scam texts impersonating businesses and organisations.

Prominent examples include scam texts purporting to be from An Post, eFlow, and WhatsApp messages claiming to be from people's children after having their phone stolen.

"We're hoping that whatever advice we give applies to all scams and all types of fraud really. We have three demographics we look at; Businesses, older people, and youth. Youth is about money mules etc.

"With old people it's often text message and email scams, but they apply to everyone. The advice we give is the same, looking out for those red flags. The same tactics apply for most scams.

'Sense of urgency'

"There is always a sense of urgency, you have to act quickly because 'your account is going to be cut off, your money is not safe, you need to verify, activate customs charge or your parcel won't be delivered'.

"It's something that applies to everyday life and the sense of urgency to make you act without thinking. If it's a phone scam, which older people get targeted a little bit more with, one reason being they have landlines.

"Just because it looks like a real number don't trust it. Banks will never send a link in text messages or ask for personal or financial information."

On the investment scams targeting older people, Ms Davenport urged anyone considering one to seek outside advice as fraudsters can have websites that appear professional.

For anyone who has made a transfer they are sceptical about, she said contacting your bank as soon as possible is the best thing to do.

"When people access their websites, for investment bonds are whatever, they look professional and have forms for follow-up calls. They're easy to fall for. One pay day is hugely profitable for them, one person being scammed can give them a year's salary for the average worker.

The quicker you contact your bank, the more likely you are to get your funds back.

"People are not as cautious talking about fraud now but with the larger ones they are still afraid to come forward. These are where transfers have actually been made. The quicker you contact your bank the more likely you are to get your funds bank. But if the fraudster has already withdrawn the money, it's too late.

"Even if you didn't make the transfer, the information can help gardaí trace the scams through the IBANs and account numbers you were given for the transfer."

While there has been a rise in these cases in recent months, she said true figures are difficult to access because people are often reluctant to come forward.

However, she stressed it is nothing to be ashamed of, adding that coming forward can help others from being targeted.