The cut-off for the standard rate of income tax has been increased by €3,200 in the Budget, while the main tax credits increased by €75. The Government is also preparing the way for a third rate of income tax, which could be introduced from January 2024.

Other changes announced in Tuesday's Budget include an increase in the annual limit for non-cash rewards to employees from €500 to €1,000 without the payment of income tax, PRSI and Universal Social Charge.

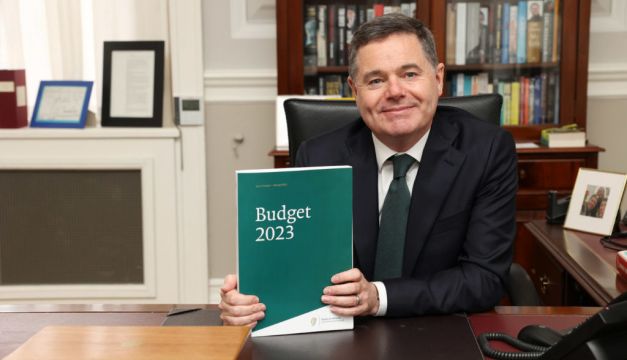

Minister for Finance Paschal Donohoe also increased the 2 per cent rate band ceiling for USC from €21,295 to €22,920. He said this was in line with the 80 cent per hour increase in the national minimum wage recently agreed by the Government.

"The increase in the USC band will ensure that full-time workers on the minimum wage will remain outside the top rates of USC, while also giving a modest benefit to all workers whose income is above that amount," he said in his Budget 2023 speech.

He extended the reduced rate of USC concession for medical cardholders for a further year.

The changes to the standard rate cut-off for income tax means the threshold increases from €36,800 to €40,000 for single individuals and from €45,800 to €49,000 for married couples/civil partners with one earner.

Changes to the tax credits see an increase of €75 in the Personal Tax Credit from €1,700 to €1,775; an increase of €75 in the Employee Tax Credit from €1,700 to €1,775; an increase of €75 in the Earned Income Credit from €1,700 to €1,775; and an increase of €100 in the Home Carer Tax Credit from €1,600 to €1,700.

The Small Benefit Exemption allows an employer to provide limited non-cash benefits or rewards to their workers without the payment of income tax, PRSI and USC.

Mr Donohoe has increased the annual limit provided for in the exemption from €500 to €1,000 and will also permit two vouchers to be granted by an employer in a single year under this exemption. The changes are due to apply to the current tax year, so that additional benefits can be paid this year if an employer wishes to do so.

Third tax rate

In his speech, the Minister for Finance addressed the recent report of the Tax Strategy Group (TSG) on the impact of introducing an intermediate or third rate of income tax.

He said further analysis of the TSG report would give options to Government on additional policy levers in future budgets to make our income tax system more balanced and effective.

"It is agreed that this analysis will commence immediately and conclude prior to the publication of next year’s Summer Economic Statement and will take into consideration the overall macroeconomic and fiscal context. This analysis will assist government in arriving at an informed decision in a timely manner."

Mr Donohoe said that were the government to opt for the introduction of a third rate of income tax, it would require considerable change to the systems in both the Revenue Commissioners and payroll providers; changes that will need significant lead-time to implement. "We are advised that this could be done for January 2024."