House prices in Ireland are now 13 per cent higher than they were one year ago, driven by very weak supply and sky-rocketing demand, according to two separate reports published on Monday.

The latest quarterly house price report from MyHome.ie found that annual asking price inflation rose by 13 per cent nationwide – 10.6 per cent in Dublin and by 13.6 per cent elsewhere around the country.

A report from property site Daft.ie found the national average house price is now €284,000, 13 per cent higher than last year and an increase of €34,000.

It means house prices have risen for four consecutive quarters for the first time since 2014, with the annual rate of inflation at its highest since early 2015.

According to the Daft.ie report, there is a continued split between trends in Dublin and trends elsewhere.

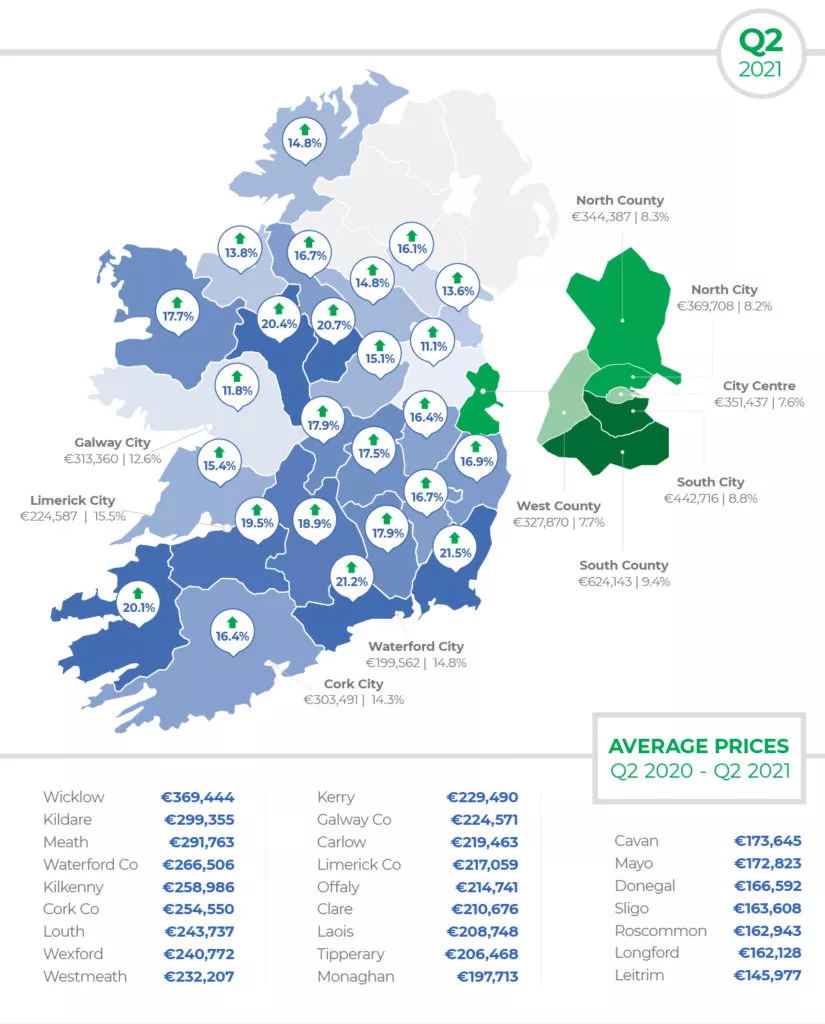

In Dublin, prices rose by 8.4 per cent in the year to June 2021, the fastest rate of inflation since early 2018, but price increases outside the capital have been roughly twice as large.

In Cork, Limerick and Waterford cities, listed prices were between 14.3 per cent and 15.5 per cent higher in the second quarter of 2021 than a year previously, while in Galway city, prices rose 12.6 per cent in the same period.

Outside the main cities, prices rose by an average of 16.5 per cent year-on-year, with Wexford and Waterford county seeing the largest increases, at just over 21 per cent.

The author of the Myhome.ie report, Conall MacCoille, chief economist at Davy, said that housing market demand was now “red-hot”, with the increase primarily due lack of supply.

“The average time to sale agreed has fallen back to a record low of 3.8 months, indicating that whatever stock is available is being purchased ever more quickly. Once again transactions are now being settled above asking prices.”

He added: “The news that asking price inflation has returned to double-digit levels will heap even more pressure on the Government to address the housing crisis. Unfortunately, there are no easy answers to solve Ireland’s structurally high build costs and lack of construction sector capacity.”

Angela Keegan, managing director of MyHome.ie, said the fact that homebuyers were increasingly desperate to secure homes was not good for the market.

“Once again, we are seeing the results of the imbalance between sluggish supply and sky-rocketing demand in the property market. Even though we expect property price inflation to dip into single digits by the end of the year, this is a stark warning of the need for increased supply throughout the country.”

Very weak supply

The author of the Daft.ie report, Ronan Lyons, economist at Trinity College Dublin, said “very weak supply” was plaguing the State's housing market.

“While the volume of second-hand homes listed for sale has improved somewhat in the second quarter compared to the first three months of the year, it remains very weak compared to the pre-pandemic housing market. An easing of lockdown restrictions in the second half of 2021 will help bring second-hand homes back on to the market.”

He added: “It highlights once again just how important supply is in determining housing prices, given strong demand. It also serves as a reminder to policymakers that, when the pandemic subsides, construction of new homes at a far greater scale than in recent years is needed to ensure housing becomes more affordable.”